Emery Partners Income Credit Strategies Fund

Overview

Emery Partners Income Credit Strategies Fund (“EPICS”) is a continuously offered, closed-end tender offer fund designed to generate current income with low volatility through targeted allocations to differentiated, institutional-quality specialty finance investments. EPICS provides a single point of access to a diversified portfolio of opportunistic credit managers, co-investments, and direct investments via a simplified structure. EPICS primarily invests in credit assets that are short in duration, uncorrelated to traditional markets, and self-liquidating. These opportunities are typically complex and require a high degree of specialization to source and manage. Target markets are often undercapitalized and under-competed, which includes strategies such as trade finance, bridge lending, government receivables, inventory/invoice factoring, and other debt-like instruments. EPICS is intended to complement traditional fixed income portfolios by preserving capital, generating distributable income, and providing liquidity.

Target Markets

We target markets are often complex or misunderstood, requiring a high degree of specialization. Transactions typically feature:

Structural protections / first loss capital

Asset over-collateralization

Equity upside through warrants

Credit upgrades such as insurance

Uncorrelated risk profiles

Ring fenced cash flows

Attractive yields

Short durations

Self-liquidating payment structures

Working Capital Solutions

Trade Finance

Royalties

Asset Backed Loans

Government Receivables

Consumer Loans

SME Loans

Real Estate Bridge Loans

Attractive Return Profile

8-12% target net annualized return

Quarterly cash distributions

Capital preservation and income

Short duration portfolio

Low Fees & Liquidity

0.85% management fee

Negotiated terms with managers

Cost structure lower than the “2 & 20”

Semi-annual tender process

Access & Lower Minimums

$50,000 minimum

Accredited & Qualified Accounts (IRAs)

Access to limited opportunities

Diversification

Diversified portfolio of managers and co-investments with a single access point

Exposure to thousands of credits

No permanent fund-level leverage

Tax

1099 Tax Reporting

No K1s or UBTI

Transparency

Quarterly Letters

Access to Portfolio Managers

Quarterly NAV and statements

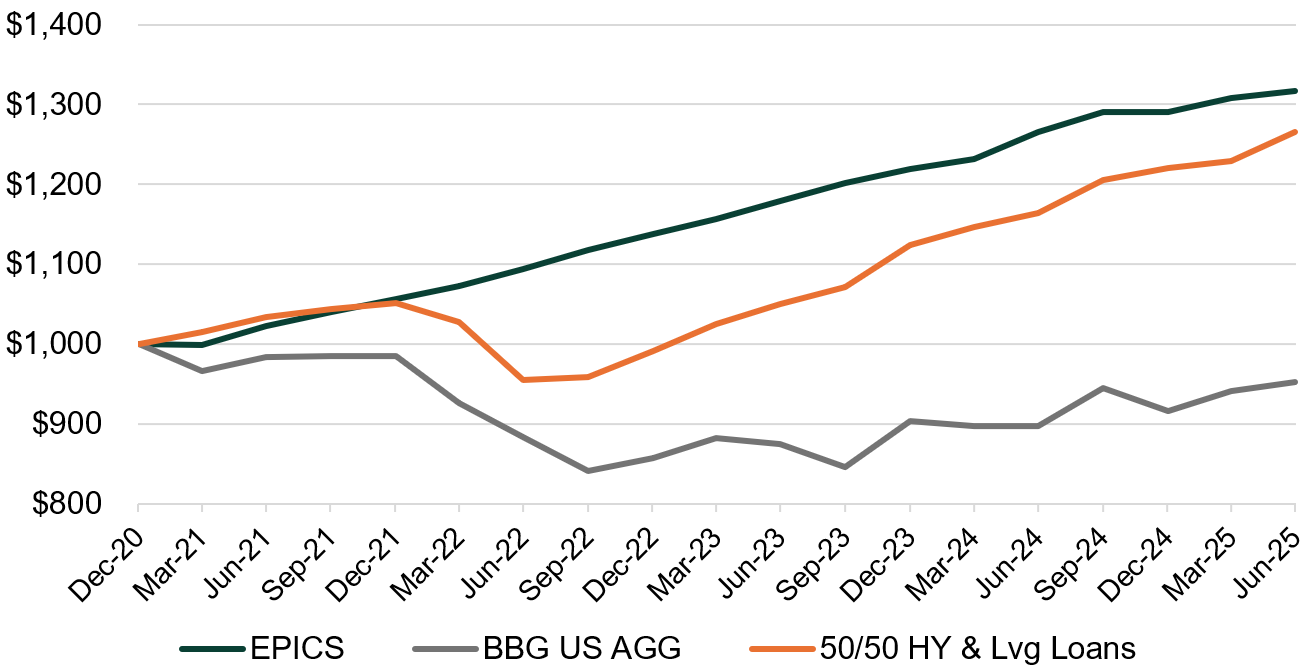

Growth of $1,000 Since Inception

Inception: January 1, 2021

Trailing Performance vs Benchmarks

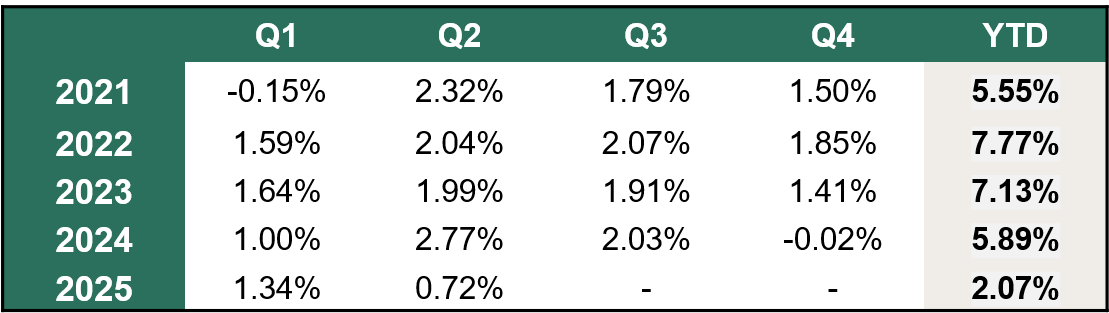

Quarterly Net Performance

Trailing returns through 6/30/2025

Key Facts

Symbol

Structure

Minimum Investment

Liquidity

Investor Requirements

EPICX

Closed-End Registered Fund

$50,000

Semi-Annual

Accredited Investor

NAV Reporting

Subscriptions

Distributions

Tax Reporting

Net Assets

Quarterly

Quarterly

Quarterly

1099-DIV

$75 million